With such a large chunk of business in Asia held by families, it is a logical step for them to consider family offices as structures to protect, transfer and manage wealth. The Asian market for family offices is relatively young, certainly when compared with that of the US, or indeed Europe, but the potential is large. In mainland China alone, more than half of family offices were set up in 2015 and 2016 to tap the emerging market, (source: South China Morning Post, citing a study led by Wu in cooperation with consultancy FOTT). Most of their assets under management are worth less than RMBbillion ($1.5 billion), according to the study, which surveyed 35 multifamily offices in China.

This article, by Jeffrey Leckstein, head of sales for Hong Kong, Taiwan and Korea at Bloomberg, considers some of the issues in play, drawing from the results of a recent conference. The editors of WealthBriefingAsia are pleased to share these insights although they don’t necessarily endorse all views of outside contributors and invite responses. Email tom.burroughes@wealthbriefing.com

Family offices in Asia are evolving rapidly as the second generation of private wealth becomes increasingly involved in strategy and operations. These younger family members are looking to modernize their operations and systems to achieve their increasingly diverse investment objectives, access new markets and remain compliant across increasingly complex markets.

The right mandate is essential

Family offices can be complex entities, especially in emerging markets where the concept is relatively new. Many Asian family offices begin as the private investment arm of a successful entrepreneur, but they tend to morph rapidly. This fluid nature means it is vital for these organisations to get their mandate right, as failure to do so inevitably leads to unforeseen problems.

Although many family offices in Asia are now pursuing more conservative investment strategies, it’s not always a natural fit. As family offices professionalise, they are moving away from traditional investment models, exploring alternatives to hedge funds and private equity funds. With net returns under pressure in uncertain capital markets, they are also developing their internal capabilities. However, as exchange traded funds and automation provide good value in liquid markets, family offices are increasingly reluctant to pay for just generic advice.

Additionally, time spent solving family conflicts, clearly setting out the family office’s objectives and defining an accurate and specific mandate is imperative especially when the stated mission goes beyond purely financial objectives.

Moving on from antiquated legacy systems

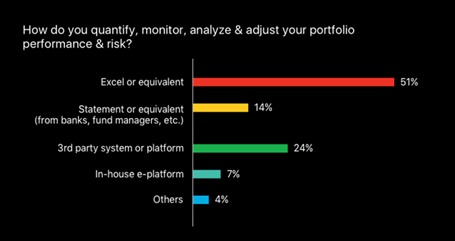

For many family offices in Asia, portfolio management and reporting remain time-intensive activities, with staff still generating reports internally in Microsoft Excel®, using data and information that banks, fund managers and other counterparties often send via fax. Adopting new technology platforms and solutions can help family offices cut costs and improve efficiency, but not all counterparties are ready for such a transition.

Poll from 2017 Bloomberg Family Office Forum

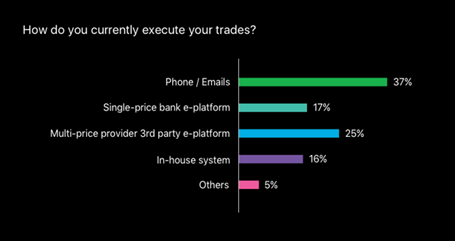

Other factors also come into consideration when making technology choices for family offices such as confidentiality and secrecy. Antiquated systems present a constant challenge, however, as phone and email communication in executing trades add a level of risk and adds to the family office’s operational burden.

Poll from 2017 Bloomberg Family Office Forum

Private banks that are able to offer electronic trading, as they seek to reduce costs and - more importantly - mitigate the risk of human error, are an important step change that need to be considered by family offices. And as multi-asset trading becomes an increasingly common trend in the industry, sophisticated analytical and research tools will play an important role for those looking to stay ahead.

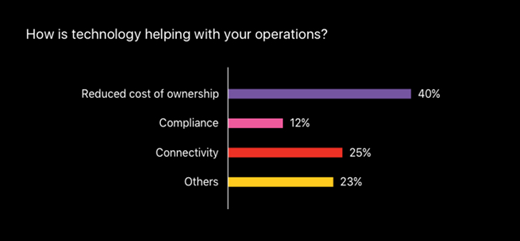

Poll from 2017 Bloomberg Family Office Forum

Adopting new technology platforms and solutions can ultimately help family offices reduce their total cost of ownership as systems evolve, especially with changing regulations and improve a family office’s workflow efficiency.

Technology and real estate remain attractive

The attitude of Asia’s family offices to risk is also changing with the last few years seeing Asian family offices going from being aggressive investors to becoming focused on generating sustainable, absolute returns. Nevertheless, some sectors remain popular.

Financial technology is currently attracting significant attention in Hong Kong, where fintech ventures are focused on renovating the city’s financial infrastructure. Cyber-security, blockchain and solutions related to wealth management, insurance and regulation - known as wealthtech, insurtech and regtech - are being overlaid on Hong Kong’s traditional areas of expertise, such as trading. Family offices in Asia also show a predilection for venture capital as a way to access technology opportunities, as noted in a recent Bloomberg report.

Another preferred sector is real estate, with many family offices – especially those from China – tending to invest in mature markets such as the US, the UK and Australia due to regulatory factors. As the migration to real estate is less complex than to private equity for many entrepreneurs, this remains an active area of investment in the region.

About the author: Jeffrey Leckstein is head of sales for Hong Kong, Taiwan and Korea at Bloomberg, the news, financial and business information service. He is based in Hong Kong.